Blog > Mortgage Rates Dip Back Into the 5% Range | Temecula Weekly Rate Update

Mortgage Rates Dip Back Into the 5% Range | Temecula Weekly Rate Update

by

Mortgage Rates Dip Back Into the 5% Range

Weekly Temecula Mortgage Rate Update

Mortgage rates showed meaningful improvement this week, opening the door to rates starting with a 5 again. For Temecula buyers and homeowners watching the market closely, this shift matters.

Rather than being driven by a routine economic report, this movement came from mortgage bond market activity that directly impacts pricing.

What Caused Mortgage Rates to Improve This Week

Mortgage rates are closely tied to mortgage backed securities. When demand for these bonds increases, lenders are able to offer more competitive pricing.

This week, markets reacted quickly to renewed activity in the mortgage bond market, helping push select loan scenarios back into the 5% range.

Current Mortgage Rate Snapshot

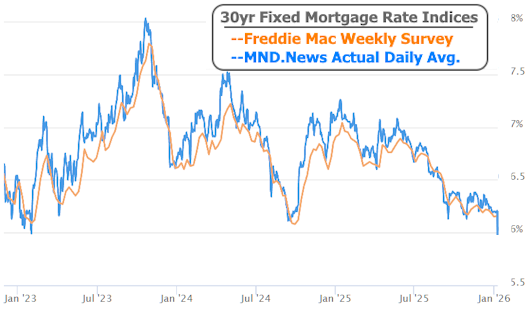

30-year fixed mortgage rate trends based on Freddie Mac and Mortgage News Daily data

- 30-year fixed conventional loans reached 5.99% in select scenarios

- 15-year fixed loans remained in the mid 5% range

- FHA and VA loans showed notable improvement in the mid to upper 5% range

Rates vary based on credit profile, loan amount, equity, property type, and lock timing. What matters most is how these numbers apply to your specific situation.

What This Means for Temecula Buyers

Even small rate improvements can increase purchasing power for buyers in Temecula and surrounding areas.

- Improved monthly affordability

- More flexibility on price or loan structure

- Stronger confidence when making an offer

What This Means for Temecula Homeowners

Homeowners may have new opportunities to refinance, improve cash flow, or access equity without touching an existing low first mortgage rate.

Bottom Line for Temecula Buyers and Homeowners

Mortgage rates have improved, and for some borrowers, 5.99% is back on the table. If you have been waiting to buy, refinance, or explore equity options, this is a week worth reviewing.