Temecula Parks Guide (2026) | Map & Complete List of City Parks

Temecula Parks Guide (2026): Every City Park + Map + Best Parks by Neighborhood Quick answer: Temecula has 40+ city parks listed by the City, ranging from neighborhood playground parks to major community & sports parks—plus trail access throughout town. Use the official Temecula Parks Map to find th

Read More

U.S. Housing Market 2025 Recap | Temecula Outlook for 2026

U.S. Housing Market in 2025: What Changed - and What It Means for Temecula in 2026 As 2025 wraps up, a lot of people are asking “What happened with the housing market this year?” After years of extreme swings, 2025 delivered something many buyers and sellers hadn’t felt in a while: a more balanced,

Read More

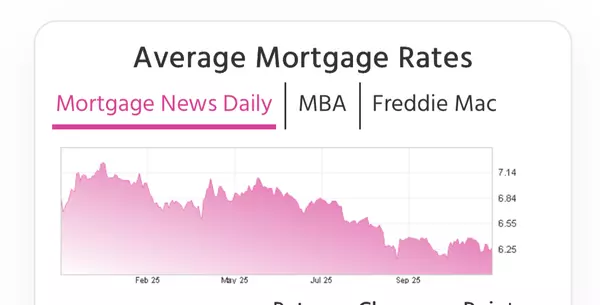

Weekly Mortgage Rate Update: Temecula Market Insights & 2026 Outlook

Weekly Mortgage Rate Update: Rates Just Off Recent Lows If you’ve been watching mortgage rates closely, this week brought a familiar theme: steady, slightly higher than recent lows, but still well below earlier 2025 highs. For buyers and homeowners across Temecula Valley and Southern California, tha

Read More

Mortgage Rates Improve After Fed Announcement

What Today’s Move Really Means for Buyers, Refinancers, and Homeowners Mortgage rates saw a nice improvement today—always great news to share—but the reason why may surprise you. This real estate market update gives a clearer picture of what actually caused today's mortgage rate movement and how it

Read More

- 1

- 2

- 3

- 4

- 5

- 6

Recent Posts